In collaboration with Intuit QuickBooks. Thank you for supporting the brands that support A Taste of Koko!

It’s been 8 years (coming up on 9 years) since I started A Taste of Koko in 2010 and it’s been a long and stressful journey. If you’re looking for a feel-good post on the perks of starting your own business and having unlimited vacay days, this isn’t it. I’m getting into the nitty-gritty of how to start your own small business – the step-by-step details that I wish I knew on month one like how to buy a website domain, year two to register an LLC, and year seven when I filed my trademark.

SEE ALSO: How Much Does It Cost To Run A Food Blog?

Get ready to put on your big girl (or big boy) pants because we’re getting down to business.

Table of Contents

50% off QuickBooks Self-Employed for 12 months!

1. DEFINING YOUR BUSINESS

So you’ve decided to take the plunge and start your business. Is it an online business that offers services or sells products? Will you start a physical storefront? Make baked goods to sell? Starting a blog? Define your business. If you’re starting a photography business, are you doing family portraits? Weddings? Restaurant photography? If you’re starting a blog, are you doing food blogging? Food blogging, in general, is quite broad so are you making your own recipes? Are you blogging about vegan restaurants? Pick a niche and become an expert in that niche so then people will pay you for your expertise in that service or product.

When I started blogging in 2010, I started with dessert recipes and baked for two years. So much so that I even started my own macaron delivery business for two years. From there, I transitioned into restaurant coverage in Austin and I’ve blogged about Austin restaurant coverage for 5 years now. My 10-second elevator pitch: A Taste of Koko is an Austin based food and travel blog that shares the hottest restaurants and weekend getaways. What’s yours?

2. PICK A BUSINESS NAME

Coming up with a business name is really hard, especially a business name that is unique and __. Make sure to cross check that business name isn’t already taken on the major social media channels (Instagram, Facebook, and Twitter) and most importantly, the web domain is available. If you’re opening a store, you’ll want to make sure your business name isn’t similar to another business in town.

I spent two months brainstorming blog names. My last name is Ko and when I was growing up, people would sometimes call me Koko. I wanted to do a food blog so I thought, “A Taste of Koko” would be a good starting point but the name stuck and people call me, “Koko.”

3. SET UP YOUR BOOKKEEPING

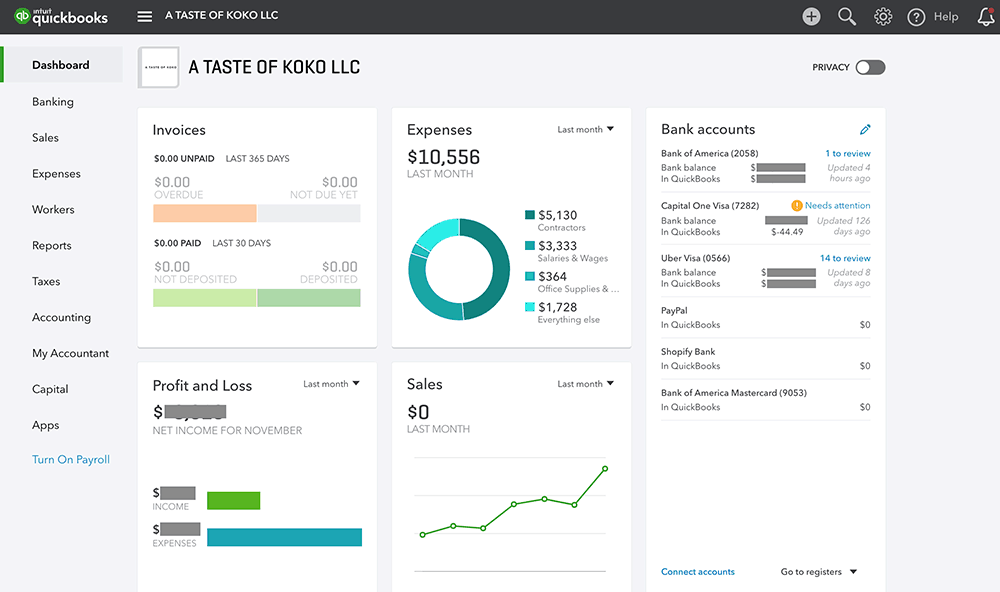

Bookkeeping is my least favorite part of running my own business but it’s important to track how much you’re making and how much you’re spending. Your first business expense? Buying that online domain and a couple dozen coffees. Yup – the perks of owning your own business is that you can expense almost everything. Intuit QuickBooks is an online accounting software for small and medium-sized businesses that are used by over 7 million small businesses and self-employed, 1/2 million accountants, and 5,000 app developers worldwide.

Click here for 50% off QuickBooks Self-Employed for 12 months!*

I’ve personally used Intuit QuickBooks for three years now and it’s been a lifesaver to be able to organize my earnings and expenses. Start by syncing up your bank account(s) and credit card(s) to QuickBooks. I love that I can use QuickBooks to also send invoices, accept business payments, conduct payroll, even track car mileage!

4. BUY A DOMAIN

There are over 1.5 billion websites on the big world wide web so it can be tricky and frustrating to find an available web domain. I recommend picking a web domain that is simple and short so it’s easy for people to remember and look up, and aim for a .com versus any other extension.

There are several websites where you can register domain names. I bought my domain on GoDaddy and have used GoDaddy for all of my domain purchases.

5. BUILD YOUR WEBSITE

Next up, you want to build your website or hire someone to build a website for you. If you’re selling services, your website will serve more as a portfolio that explains what you can offer. If you’re selling goods, you’ll need a website that has e-commerce.

When I started the blog in 2010, I launched on Blogger and then transitioned to Wordpress a couple of years later. I recommend using Wordpress since it’s the most powerful content management system (CMS) that’s best for SEO and e-commerce. I built my first couple blog design by modifying pre-made blog themes. Last year I hired a designer and web developer to build a custom website, the website you’re seeing now!

6. REGISTER YOUR DBA

After you’ve picked your business name, bought the web domain, and created the website, you’ll need to protect it. Registering your DBA (doing business as) in the state, county, or city your business is located in tells the public and other businesses that you’re doing business under that name. A DBA is also known as assumed business name. Once you’re registered and keep your registration active this means no other business can register with the exact same name. You need a DBA and EIN (federal tax ID number) to open a business bank account.

I filed my DBA in Austin with the Texas Secretary of State – the state charges $25 and the County Clerks charges about $15. A Texas DBA lasts 10 years from the date of filing. The DBA certificate can be renewed for an additional 10 year periods by filing a new assumed name certificate no more than 6 months prior to the expiration date.

7. FORM AN LLC

It’s time to suit up and form an LLC – you can prepare the legal paperwork and file it yourself, or hire a lawyer.

I hired a lawyer to file my LLC and A Taste of Koko is currently classified as an S corporation.

8. APPLY FOR AN EIN

After your LLC is approved, the next step is to get an EIN for your business. EIN is an Employer Identification Number, also known as a Federal Tax Identification Number, and is a nine-digit number assigned by the IRS for tax filing and reporting purposes. We all have a Social Security number but if you plan on incorporating, forming an LLC, or hiring employees in the future, you need an EIN. It’s free through the IRS website and you can get it immediately by applying online!

I applied for my EIN through the IRS website.

9. OPEN A BUSINESS CHECKING ACCOUNT

It’s important to separate your personal spendings from your business spendings with separate checking accounts. Trust me, you’ll thank me when taxes are due.

I opened a business checking account for A Taste of Koko after having my business for 5 years and wish I had done it a lot sooner. When I had my second business, Happy Social Co, I also opened a separate business checking account for that business so all client payments and expenses were kept separate. It makes bookkeeping and taxes so much easier!

10. ORGANIZE BOOKKEEPING

Remember setting up Intuit QuickBooks in step 3? We’re circling back to this because you’ve accumulated months of expenses and hopefully, earnings by now! QuickBooks can help you stay organized and make smarter business decisions about your business. By connecting your bank accounts and credit cards to QuickBooks, transactions will automatically import and you can then categorize the transactions into expenses.

Click here for 50% off QuickBooks Self-Employed for 12 months!*

I did my own bookkeeping on QuickBooks the first year and as my business grew, I hired a CPA to manage my bookkeeping. This year I switched to a different CPA that was better suited for my business and it was so easy for her to hop onto my QuickBooks and see the previous year’s revenue with earnings and expenses. Now at the beginning of every month, we go through the previous month’s transactions and categorize each one into the appropriate expense category. In the next blog post, I’ll share what you can and cannot expense for self-employment deductions.

11. FILE A TRADEMARK

Once you’re serious about your business and a couple of years in, I recommend filing for a trademark. From the USPTO website, “A trademark is generally a word, phrase, symbol, or design, or a combination thereof, that identifies and distinguishes the source of the goods of one party from those of others. A trademark typically protects brand names and logos used on goods and services. A copyright protects an original artistic or literary work. A patent protects an invention.”

I trademarked “A Taste Of Koko” in the online media category so no one can use “A Taste of Koko” on an online website or media. I tried to trademark “Koko” this year but it’s too generic and would cost too much money to trademark in each category. Why does this matter you ask? Let’s take Delta for example, what comes into mind first? The airline company or the faucet company? Pandora – the jewelry brand or the radio station? Trademarking is definitely optional but as you grow your business and brand try to think long term.

Have you launched an online business? What was your process?

*50% off the monthly price for QuickBooks Self-Employed is for the first 12 months of service starting from date of enrollment for new paying subscribers only (trial subscriptions are not applicable), followed by the then-current fee for the service. Additional terms, conditions, pricing, features, service, and support are subject to change without notice