In collaboration with Intuit QuickBooks. Thank you for supporting the brands that support A Taste of Koko!

Photography by Ready Set Jet Set

Thinking about working remotely? Quitting your job and becoming a freelancer? Congratulations! I quit my 9-5 job (more like 9-11pm) in 2015 as a social media manager and started doing my blog full-time and working as a freelancer and working remotely.

SEE ALSO: 9 Self-Employed Tax Deductions That You Can Write Off In 2019

It hasn’t been an easy journey as a freelancer and getting my business off the ground, and there were many lessons I learned along the way. This is my third blog post in partnership with QuickBooks, an accounting software that has been an essential tool for my business and that I would recommend to any freelancer! Here are the 7 tips for working remotely for freelancers.

Table of Contents

50% OFF QUICKBOOKS SELF-EMPLOYED FOR 12 MONTHS!

1. CHECK YOUR FINANCES

Checking your finances is never fun but it’s crucial to see how much money you have saved in the bank before you quit your job. Depending on where you live and where you want to travel to and work from, the amount of savings will vary. New York and San Francisco have a higher cost of living compared to Houston or Phoenix. Southeast Asia like Vietnam and Thailand are much cheaper to live and work remotely compared to destinations like Iceland. I went to Iceland for 7 days last year to drive the Iceland Ring Road and it was incredibly expensive.

Start by syncing your bank accounts into QuickBooks Self-Employed so you can see at a glance how much money you have and what your runway looks like.

2. PLAN OUT YOUR WORK DAY

It’s so tempting to lie on by the pool all day but you need to establish structure when working remotely. Here’s what a typical travel day looks like for me as a blogger:

- 6am – 9am: wake up to shoot photos before it gets too bright

- 9am – 4pm: eat breakfast/lunch and respond to emails & take phone calls.

- 4pm – 8pm: shoot photos until sunset

- 8pm – 12pm: edit photos and write content

I also make it an effort to do a little bit of secretarial work every day like sorting through receipts and organizing expenses on QuickBooks so it’s not as overwhelming at the end of the month. If I’m eating out for a business meal, I use the QuickBooks app to take a picture of the receipt and it easily uploads it to the dashboard so I can categorize it later.

3. INVEST IN YOUR BUSINESS

I am constantly investing in my business. My very first investment for the blog was buying a DSLR and spending hours on Google reading up on website development and social media marketing. Even if you’re a couple of years into your business and your business is running smoothly, I recommend investing in some aspect of it. Year seven, I decided to invest $15,000 in hiring a designer, web developer, and SEO consultant to design, build and optimize the website you’re reading right now. That same year, I also decided to invest in a new camera – switching from the Canon 5D Mark III to the Sony A7Rii mirrorless camera (pictured above). This year I just hired a Pinterest management agency to help increase my website traffic. You can write all of this off as business expenses and QuickBooks makes it easy to organize your expenses for tax deductions!

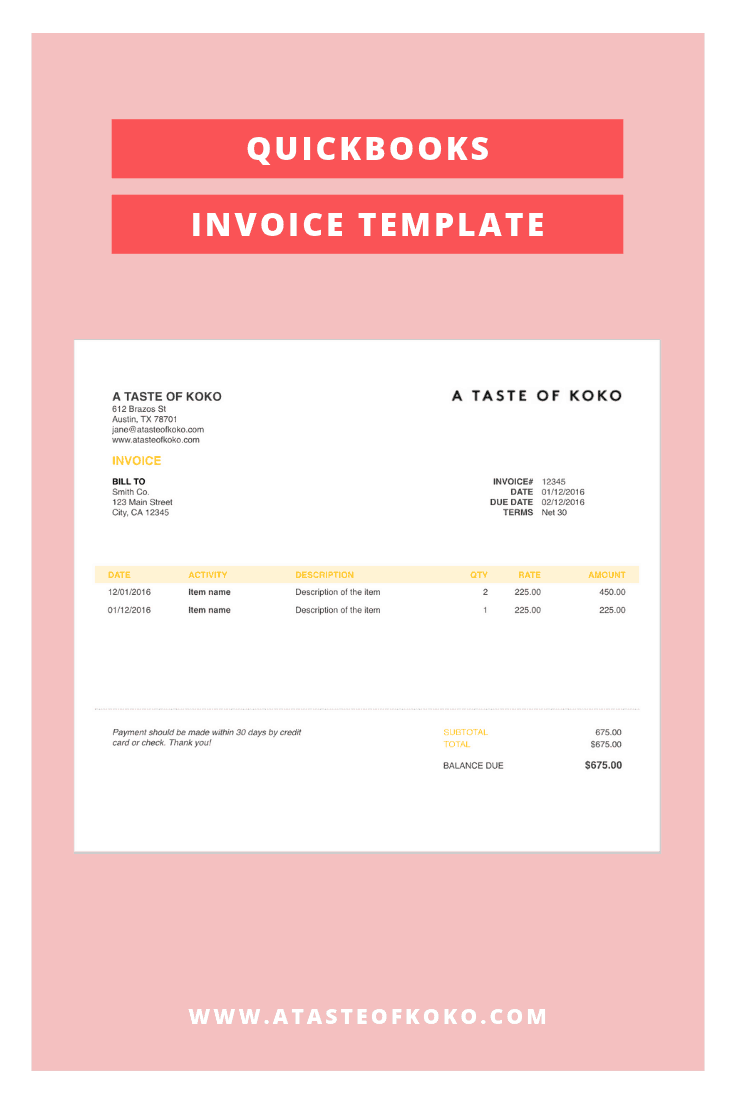

4. FREELANCE INVOICE TEMPLATE

Make that money! And to make that money, you’ll need to create a freelance invoice template and you can conveniently create invoices through QuickBooks. You can easily send invoices to your clients that both look professional and can easily be paid by credit card, Apple Pay, free ACH bank transfer, or over the phone! Here is an example of an invoice that I would send to a brand for a blog campaign.

If you’re doing on-going work where the client needs to pay you x amount every month, schedule automated invoices through QuickBooks. It’s a game changer. When I was running my social media management company, I would have invoices go out to my clients the fifth day of every month for that month’s services and they would have five days to pay the invoice or else services would pause.

HOW TO CUSTOMIZE INVOICES ON QUICKBOOKS

- Select the Gear icon on the top right of the Toolbar, then Custom Form Styles under Your Company.

- Select New Style, and choose a type of transaction from the drop down.

- Start with the Design tab to personalize the invoice template, add your logo, add color, change the fonts, and edit print settings.

- In the Content tab, you can edit the header, the table, and the footer.

- Select Preview PDF or Done on the black Toolbar to save the invoice template.

5. ORGANIZE YOUR EXPENSES

I’ve talked about expenses quite extensively in my last blog post, 9 Self-Employed Tax Deductions That You Can Write Off In 2019, where I also shared how I organize my expenses throughout the year but it’s so important. Anything that you spend for your business is an expense that you can write off! I have all of my bank accounts and credit cards synced up with QuickBooks and the beginning of every month I go through all the transactions and categorize them. All those investments that I mentioned earlier, you can write those off as business expenses!

6. TAKE THE LEAP BUT WITH CUSHION

Working remotely and freelancing isn’t for everyone. Some people need structure and like knowing how much they’re going to make at the end of the year and the benefits of health insurance and vacation days. Some people don’t want to be tied to a desk and get bored with routine and want the flexibility to travel. For me, I started the blog in 2010 and worked at various companies as a social media manager along the way. In 2015, the company I worked at and the boss I worked under became a toxic situation so I quit my job without a plan B. Luckily the blogging industry changed that year and I started to do paid partnerships with different brands.

Since I worked for several years already, I had some savings in my bank account to have a one-year runway. If you’re going to quit your job, I recommend having some cushion before going into freelancing and working remotely because you never know when you’re going to be paid. Some people don’t make anything in their first year of business! For blogging, it’s industry standard to not get paid until 30-days later or sometimes, even 60-days later for a project.

SEE ALSO: How To Start An Online Business

My remote office!

7. FIND YOUR OPTIMAL WORKSPACE

Some people are disciplined enough to work from home and not distracted by miscellaneous tasks like washing the dishes and doing the laundry. Don’t get me wrong – there are days when I work from home and get no work accomplished but I’ve managed to somehow finish the home chores, including giving my dog a bath. I typically stand and work from my kitchen counter and get computer work done in the morning. Some days I might go to my coworking space if I have meetings or I’ll work from a coffee shop. My favorite coffee shops to work out of in Austin:

- Houndstooth on MLK

- Halcyon in Mueller

- Figure 8 Coffee

- Greater Goods

- Brew & Brew

If you’re getting into freelance, it’s important to find a space where you can focus and get work done and not be distracted. I actually discovered that I get quite a bit of work done at the airport and mid-flight. Right now I’m flying across the Pacific Ocean to Hawaii and while there’s no Wi-Fi so I can’t watch movies I can focus and start writing this blog post!

*50% off the monthly price for QuickBooks Self-Employed is for the first 12 months of service starting from date of enrollment for new paying subscribers only (trial subscriptions are not applicable), followed by the then-current fee for the service. Additional terms, conditions, pricing, features, service, and support are subject to change without notice